Resources

Creating an Intentional

Plan for Your Money

Hello, if you’ve made it here, you’ve probably read my friend Lulu Trevena’s wonderful collaborative book, Wholehearted Wonder Women 50+, Courage, Creativity & Confidence at Any Age. You likely have also read my contribution to that book, chapter 14, Inspired Wealth, Creating an Intentional Plan for Your Money. Hopefully, you are inspired to make some changes and to take your engagement with money to another level.

Values Alignment

In Step 1, I talk about getting clear about the purpose of money for you. It can be helpful to have clarity around your core values as part of this exploration. You can use these pdf’s to explore your values and to take a look at how your money use lines up with those values.

Tracking Your Money

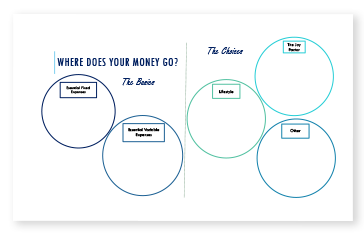

In Step 2, I talk about tracking your money. Tracking your spending doesn’t have to be time-consuming and it definitely can be illuminating. Most commonly, expenses fall into what is either essential or discretionary. Essential being the roof over your head, clothing, food, safety and security. Discretionary being anything that is optional or a choice once those basic needs are met.

Everyone has a different preference for what tools they use. Some love a spreadsheet, others want to use a money journal, still others will be content to use automated tracking with a free tool like Mint, or the tracking that is provided by their bank or credit union (not all financial institutions provide these, but many do).

For this latter option there is some work involved if you want to make sure the categories that are setup by default are correct, but after that, it’s a relatively easy way to stay on top of your spending.

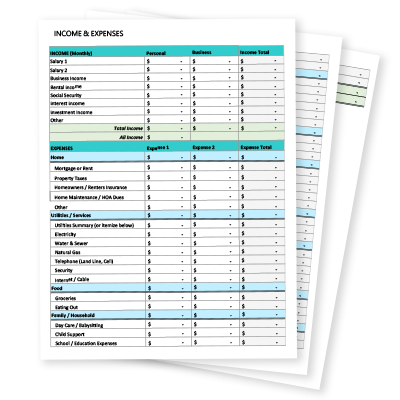

If you want to start with a spreadsheet, download this editable sheet that you can expand or change to meet your needs.

If spreadsheets and online tracking aren’t your thing, grab a large sheet of blank paper, your favorite pens or crayons and draw it out!

Don’t let discomfort with numbers or conventional ways of tracking spending get in the way of understanding how your money is working for you.

In Step 3 I talk about directing your money according to the purpose you have given it and in Step 4, having some compassion along the way. Don’t forget to celebrate your successes and use any perceived failures as a learning tool, not a reason to give up.

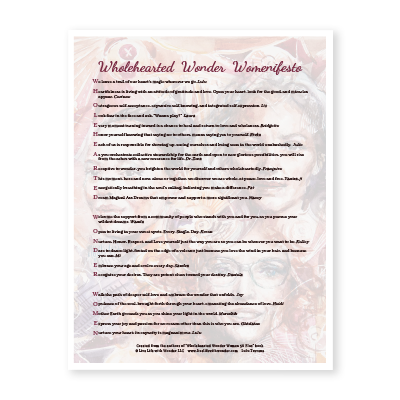

Included on my resources page is this lovely Wholehearted Wonder “Womenifesto”, with a one-line comment from each author in the book. Enjoy!