17 Dec 2021 Business Planning

Adoption Assistance Programs

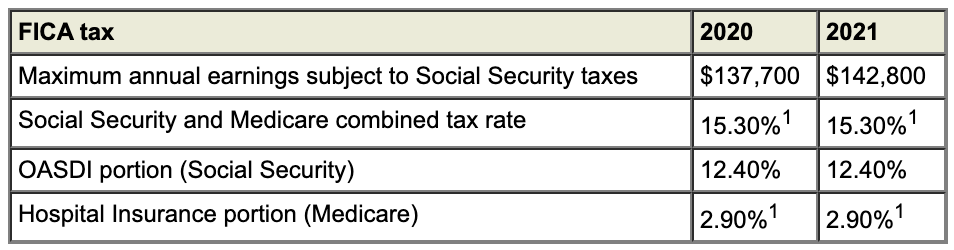

Earnings subject to FICA taxes (taxable wage base)

1 An additional Medicare (HI) employee contribution rate of 0.9% (for a total employee contribution of 2.35%, and a total combined Medicare contribution rate of 3.8%) is assessed on wages exceeding $200,000 ($250,000 for married couples filing joint returns, $125,000 for married individuals filing separate returns). For married individuals filing joint returns, the additional 0.9% tax applies to the couples combined wages (to the extent the combined wages exceed $250,000).

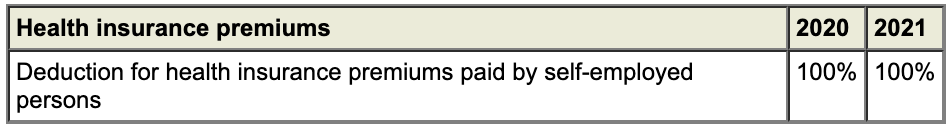

Health insurance deduction for self-employed

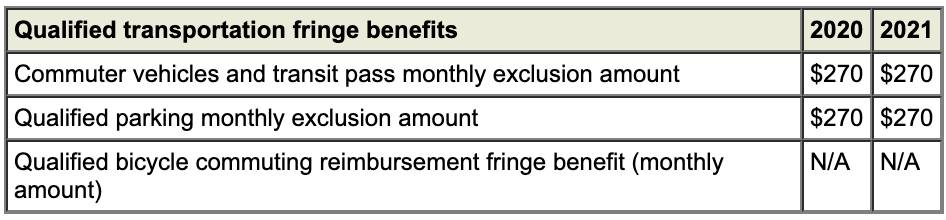

Qualified transportation fringe benefits

Section 179 expensing

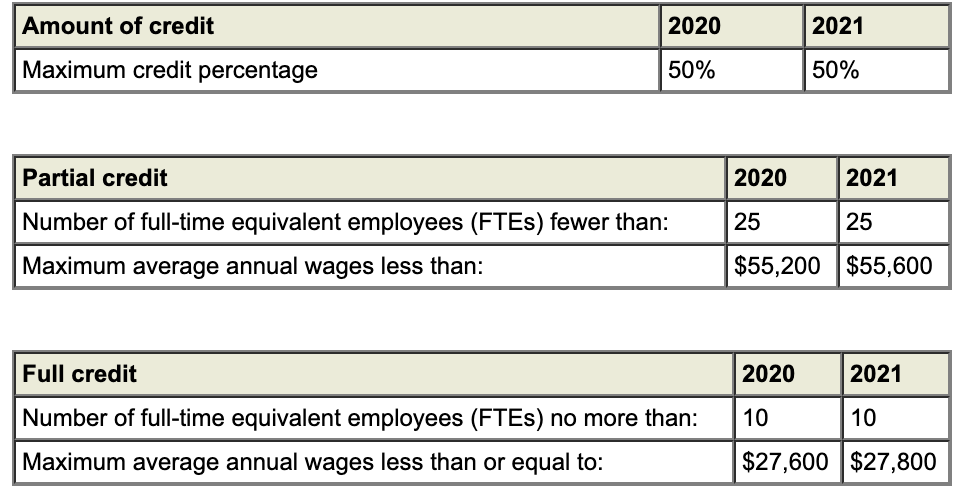

Small business tax credit for providing health-care coverage

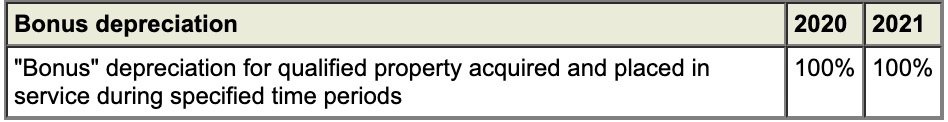

Special additional first-year depreciation allowance

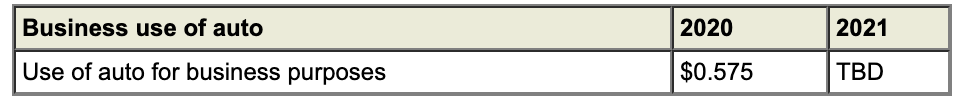

Standard mileage rate (per mile)

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

This information was developed by Broadridge, an independent third party. It is general in nature, is not a complete statement of all information necessary for making an investment decision, and is not a recommendation or a solicitation to buy or sell any security. Investments and strategies mentioned may not be suitable for all investors. Past performance may not be indicative of future results.

Prepared by Broadridge Advisor Solutions Copyright 2021.