24 Sep IRS Releases 2022 Key Numbers for Health Savings Accounts

The IRS has released the 2022 contribution limits for health savings accounts (HSAs), as well as the 2022 minimum deductible and maximum out-of-pocket amounts for high-deductible health plans (HDHPs). An HSA is a tax-advantaged account that’s paired with an HDHP. An HSA offers several valuable tax benefits:

The IRS has released the 2022 contribution limits for health savings accounts (HSAs), as well as the 2022 minimum deductible and maximum out-of-pocket amounts for high-deductible health plans (HDHPs). An HSA is a tax-advantaged account that’s paired with an HDHP. An HSA offers several valuable tax benefits:

- You may be able to make pre-tax contributions via payroll deduction through your employer, reducing your current income tax.

- If you make contributions on your own using after-tax dollars, they’re deductible from your federal income tax (and perhaps from your state income tax) whether you itemize or not.

- Contributions to your HSA, and any interest or earnings, grow tax deferred.

- Contributions and any earnings you withdraw will be tax-free if used to pay qualified medical expenses.

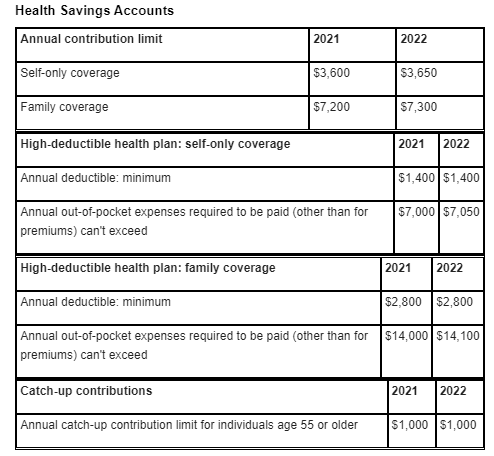

Here are the key tax numbers for 2021 and 2022.

This information was developed by Broadridge, an independent third party. It is general in nature, is not a complete statement of all information necessary for making an investment decision, and is not a recommendation or a solicitation to buy or sell any security. Investments and strategies mentioned may not be suitable for all investors. Past performance may not be indicative of future results.

Prepared by Broadridge Advisor Solutions Copyright 2021.