09 Feb 2024 Key Numbers – Retirement Planning

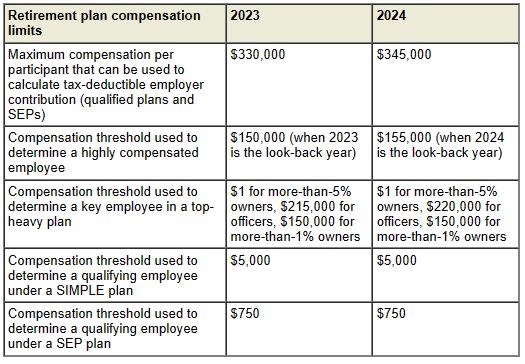

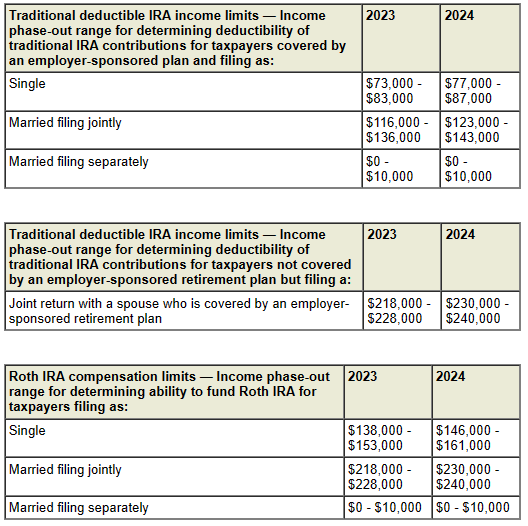

2024 and 2023 contribution rates for employer and individual retirement accounts, including income phase-outs for IRA deductions and ROTH IRA contributions.

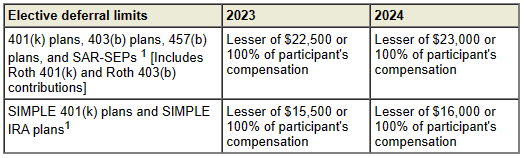

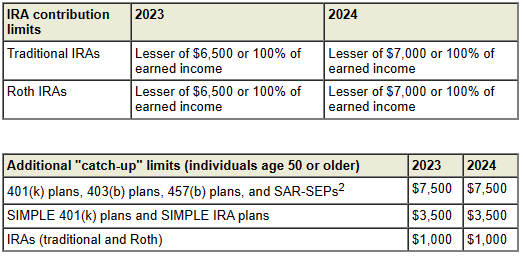

Employee/individual contribution limits

1 Must aggregate employee contributions to all 401(k), 403(b), SAR-SEP, and SIMPLE plans of all employers. 457(b) plan contributions are not aggregated. For SAR-SEPs, the percentage limit is 25% of compensation reduced by elective deferrals (effectively, a 20% maximum contribution).

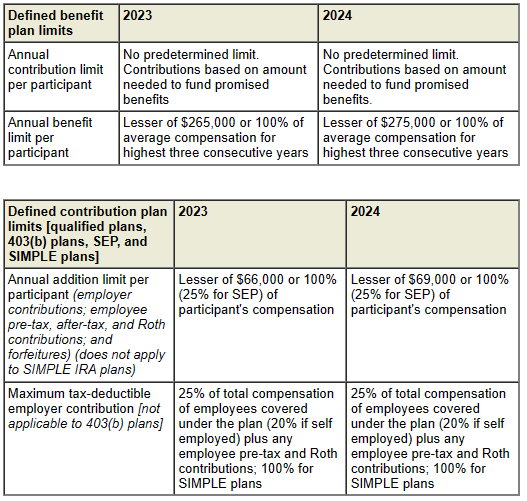

2 Special catch-up limits may also apply to 403(b) and 457(b) plan participants. Employer contribution/benefit 3 limits

3 For self-employed individuals, compensation generally means earned income. This means that, for qualified plans, deductible contributions for a self-employed individual are limited to 20% of net earnings from self-employment (net profits minus self-employment tax deduction), and special rules apply in calculating the annual additions limit. Compensation limits/thresholds

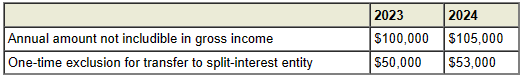

Qualified charitable distribution

|

| This information was developed by Broadridge, an independent third party. It is general in nature, is not a complete statement of all information necessary for making an investment decision and is not a recommendation or a solicitation to buy or sell any security. Investments and strategies mentioned may not be suitable for all investors. Past performance may not be indicative of future results.

Prepared by Broadridge Advisor Solutions Copyright 2024. |