17 Dec 2021 Individual Income Tax Planning

Adoption credit

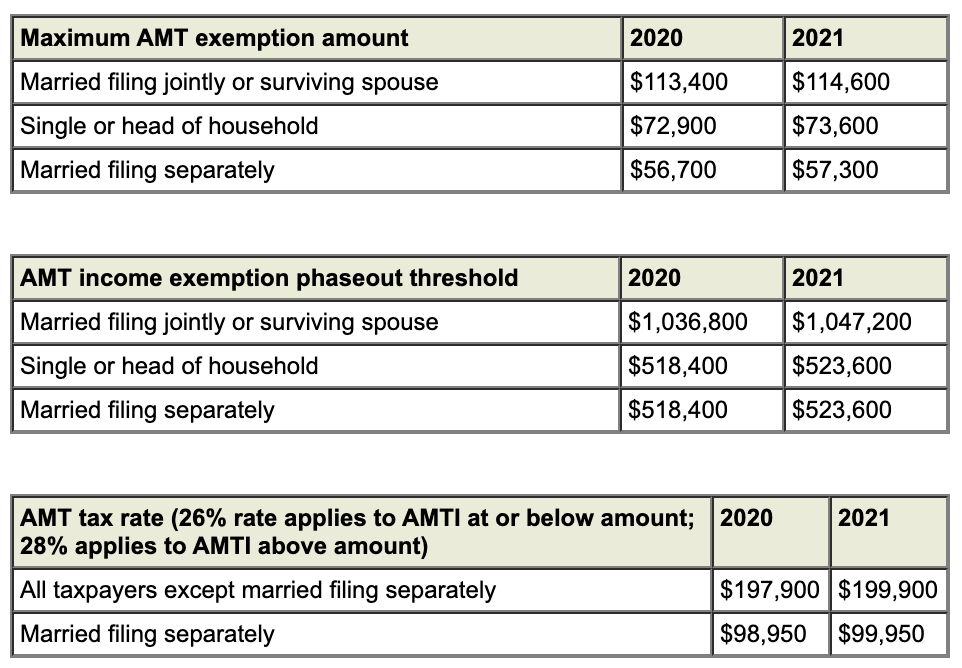

Alternative Minimum Tax (AMT)

Charitable deductions

1 Contribution is fully deductible if minimum contribution amount is met and cost of token gift does not exceed maximum

2 Charitable contribution is fully deductible if the benefit received by the donor doesn’t exceed the lesser of the threshold amount or 2% of the amount of the contribution

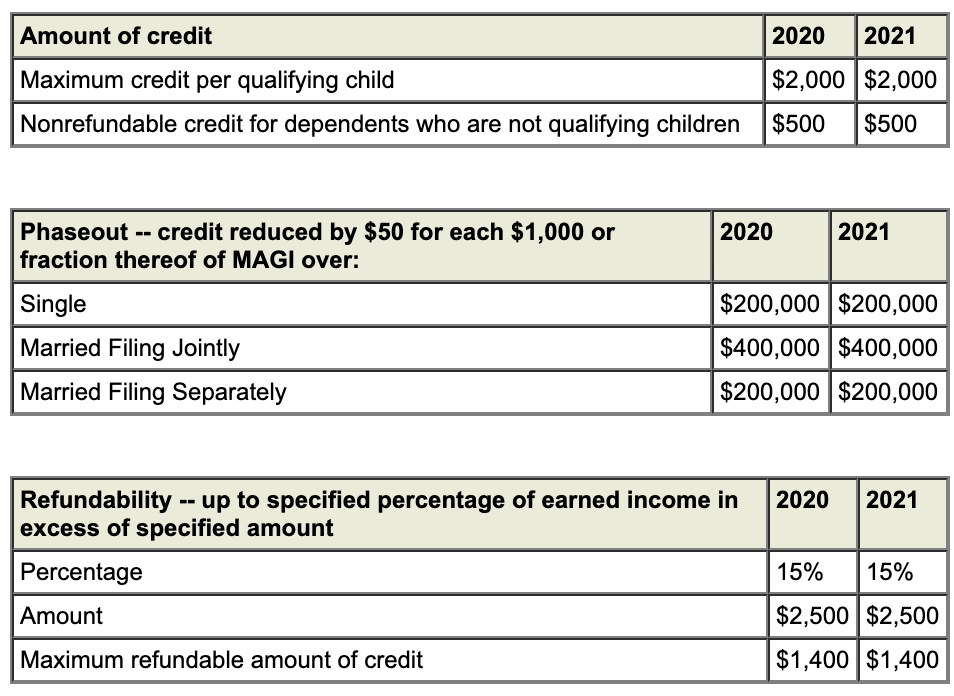

Child tax credit

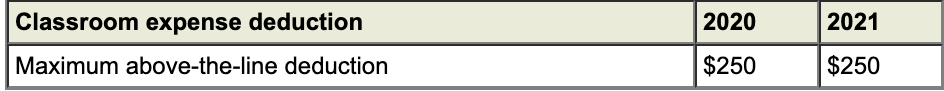

Classroom expenses of elementary and secondary school teachers

Earned income tax credit (EITC)

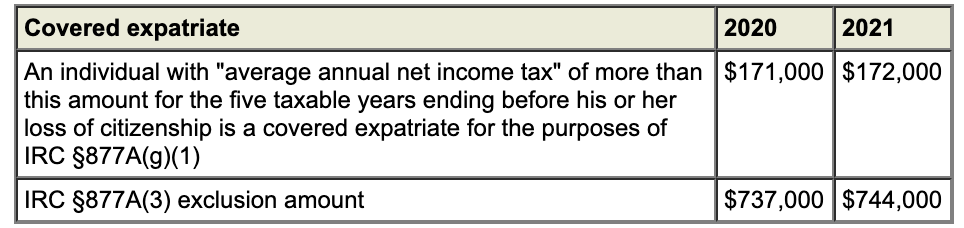

Expatriation

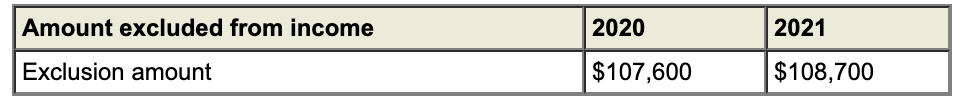

Foreign earned income

Itemized deductions

Kiddie tax

1 Taxed at parents’ tax rates in 2020 and 2021. In 2019, taxed at trust and estate income tax rates (special rules apply to alternative minimum tax purposes) but retroactive election may be made to tax at parents’ tax rates.

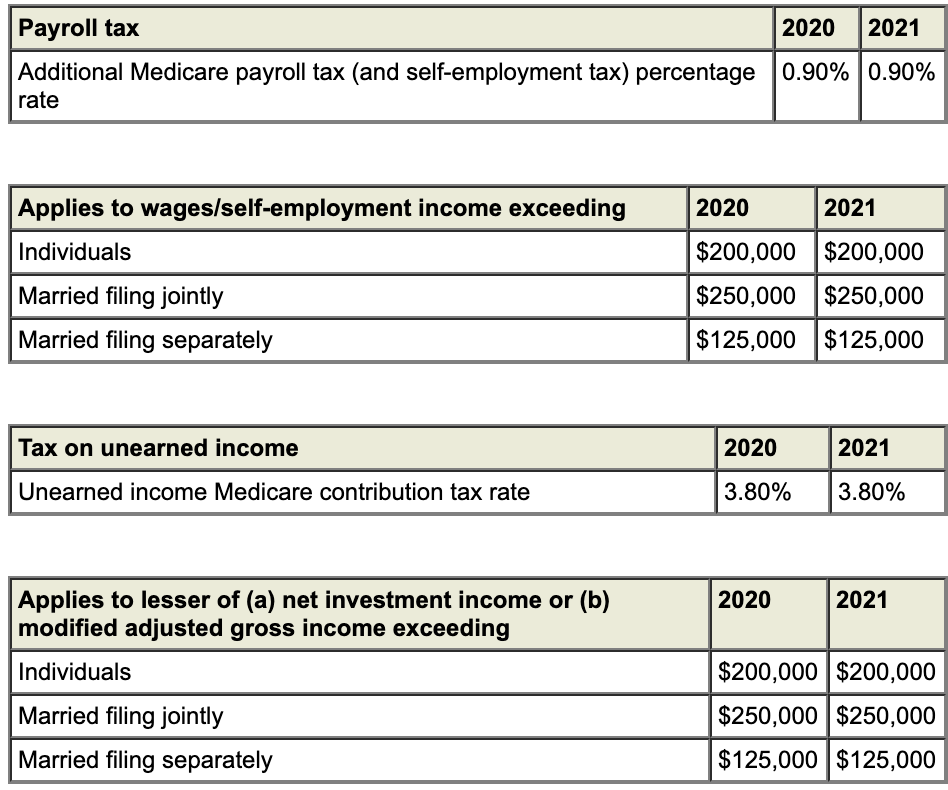

Medicare tax (additional payroll tax and unearned income contribution tax)

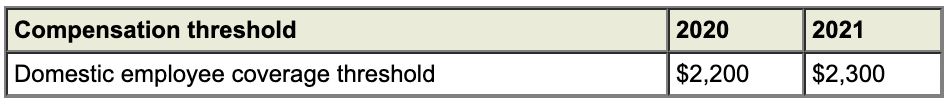

Nanny tax

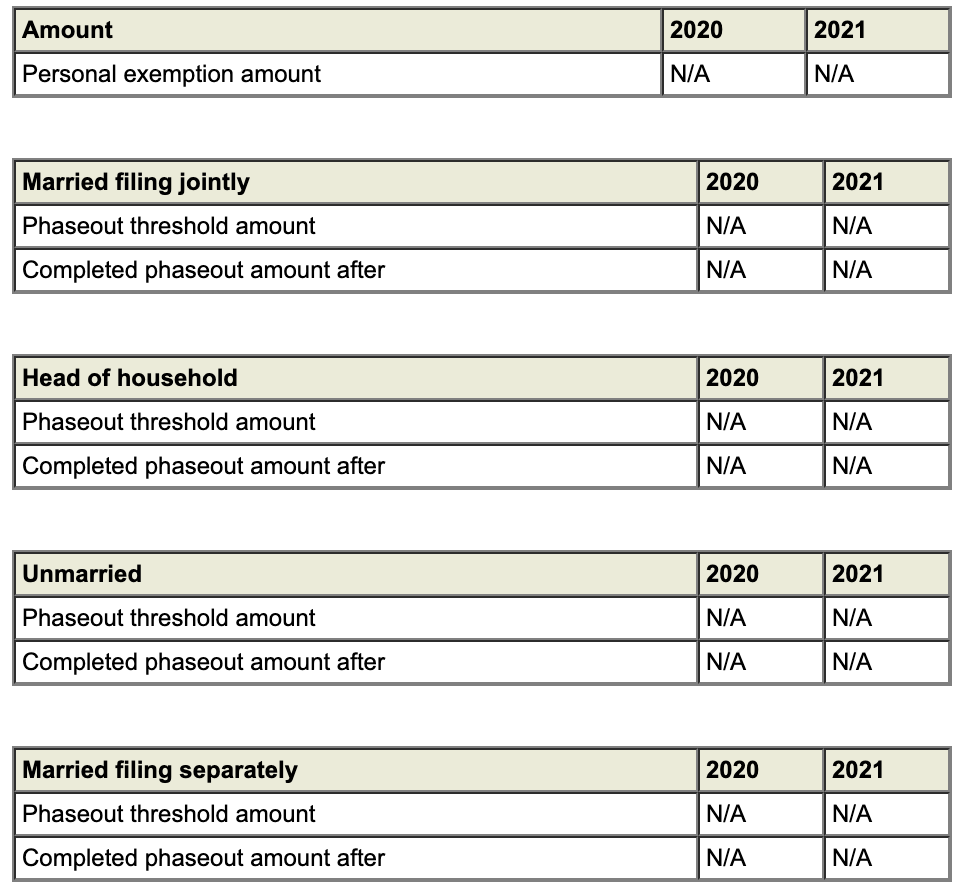

Personal exemption amount

“Saver’s Credit”

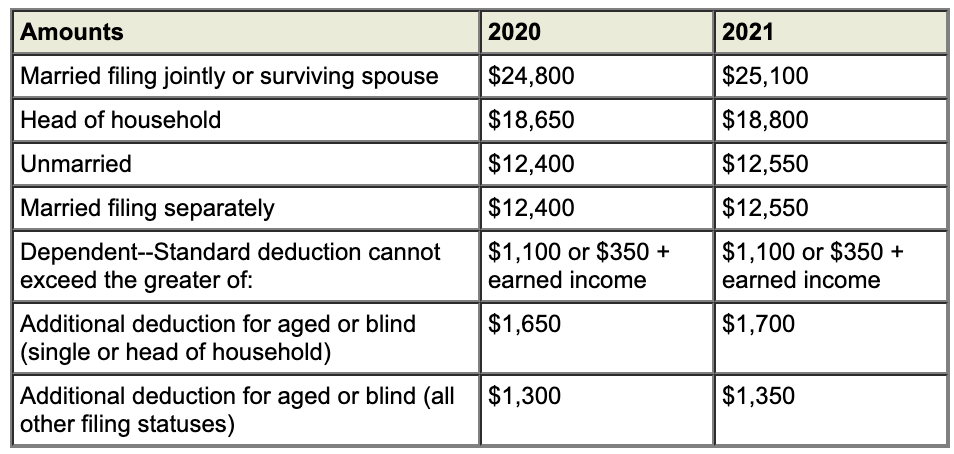

Standard deductions

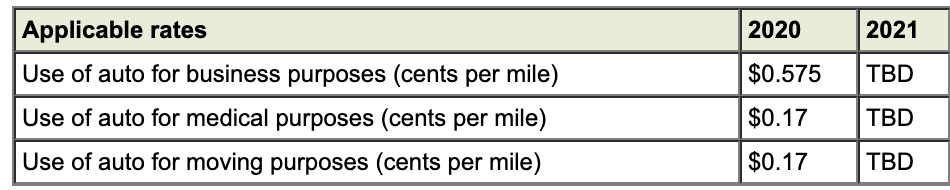

Standard mileage rates

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

This information was developed by Broadridge, an independent third party. It is general in nature, is not a complete statement of all information necessary for making an investment decision, and is not a recommendation or a solicitation to buy or sell any security. Investments and strategies mentioned may not be suitable for all investors. Past performance may not be indicative of future results.

Prepared by Broadridge Advisor Solutions Copyright 2021.