08 Dec Is Now a Good Time to Consider a Roth Conversion?

This year has been challenging on many fronts, but one financial opportunity may have emerged from the economic turbulence. If you’ve been thinking about converting your traditional IRA to a Roth, now might be an appropriate time to do so.

This year has been challenging on many fronts, but one financial opportunity may have emerged from the economic turbulence. If you’ve been thinking about converting your traditional IRA to a Roth, now might be an appropriate time to do so.

Conversion Basics

Roth IRAs offer tax-free income in retirement. Contributions to a Roth IRA are not tax-deductible, but qualified withdrawals, including any earnings, are free of federal income tax. Such withdrawals may also be free of any state income tax that would apply to retirement plan distributions.

Generally, a Roth distribution is considered “qualified” if it meets a five-year holding requirement and you are age 59½ or older, become permanently disabled, or die (other exceptions may apply).

Regardless of your filing status or how much you earn, you can convert assets in a traditional IRA to a Roth IRA. Though annual IRA contribution limits are relatively low ($6,000 to all IRAs combined in 2020, or $7,000 if you are age 50 or older), there is no limit to the amount you can convert or the number of conversions you can make during a calendar year. An inherited traditional IRA cannot be converted to a Roth, but a spouse beneficiary who treats an inherited IRA as his or her own can convert the assets.

Converted assets are subject to federal income tax in the year of conversion and may also be subject to state taxes. This could result in a substantial tax bill, depending on the value of your account, and could move you into a higher tax bracket. However, if all conditions are met, the Roth account will incur no further income tax liability and you won’t be subject to required minimum distributions. (Designated beneficiaries are required to take withdrawals based on certain rules and time frames, depending on their age and relationship to the original account holder, but such withdrawals would be free of federal tax.)

Why Now?

Comparatively low income tax rates combined with the impact of the economic downturn might make this an appropriate time to consider a Roth conversion.

The lower income tax rates passed in 2017 are scheduled to expire at year-end 2025; however, some industry observers have noted that taxes may rise even sooner due to rising deficits exacerbated by the pandemic relief measures.

Moreover, if the value of your IRA remains below its pre-pandemic value, the tax obligation on your conversion will be lower than if you had converted prior to the downturn. If your income is lower in 2020 due to the economic challenges, your tax rate could be lower as well.

Any or all of these factors may make it worth considering a Roth conversion, provided you have the funds available to cover the tax obligation.

As long as your traditional and Roth IRAs are with the same provider, you can typically transfer shares from one account to the other. When share prices are lower, as they may be in the current market environment, you could theoretically convert more shares for each dollar and would have more shares in your Roth account to pursue tax-free growth. Of course, there is also a risk that the converted assets will go down in value.

Using Conversions to Make “Annual Contributions”

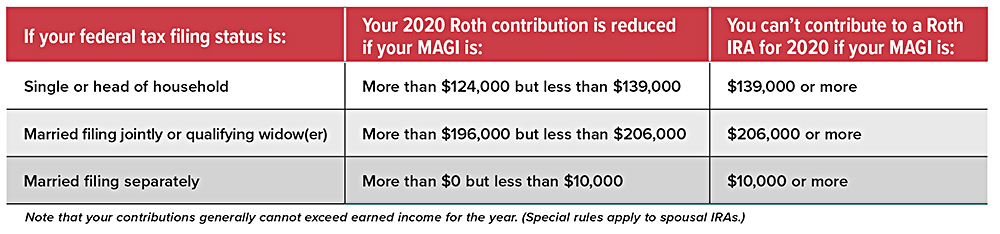

Finally, if you are not eligible to contribute to a Roth IRA because your modified adjusted gross income (MAGI) is too high (see table), a Roth conversion may offer a workaround. You can make nondeductible contributions to a traditional IRA and then convert traditional IRA assets to a Roth. This is often called a “back-door” Roth IRA.

As this history-making year approaches its end, this is a good time to think about last-minute moves that might benefit your financial and tax situation. A Roth conversion could be an appropriate strategy.

All investing involves risk, including the possible loss of principal, and there is no guarantee that any investment strategy will be successful.

This information was developed by Broadridge, an independent third party. It is general in nature, is not a complete statement of all information necessary for making an investment decision, and is not a recommendation or a solicitation to buy or sell any security. Investments and strategies mentioned may not be suitable for all investors. Past performance may not be indicative of future results.

Prepared by Broadridge Advisor Solutions Copyright 2020.