14 Apr Key Retirement and Tax Numbers for 2017

Every year, the Internal Revenue Service announces cost-of-living adjustments that affect contribution limits for retirement plans, thresholds for deductions and credits, and standard deduction and personal exemption amounts. Here are a few of the key adjustments for 2017.

Every year, the Internal Revenue Service announces cost-of-living adjustments that affect contribution limits for retirement plans, thresholds for deductions and credits, and standard deduction and personal exemption amounts. Here are a few of the key adjustments for 2017.

Retirement plans

Employees who participate in 401(k), 403(b), and most 457 plans can defer up to $18,000 in compensation in 2017 (the same as in 2016); employees age 50 and older can defer up to an additional $6,000 in 2017 (the same as in 2016).

Employees participating in a SIMPLE retirement plan can defer up to $12,500 in 2017 (the same as in 2016), and employees age 50 and older will be able to defer up to an additional $3,000 in 2017 (the same as in 2016).

IRAs

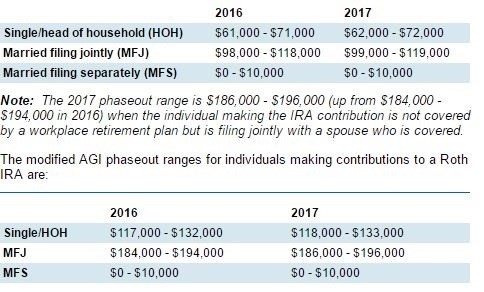

The limit on annual contributions to an IRA remains unchanged at $5,500 in 2017, with individuals age 50 and older able to contribute an additional $1,000. For individuals who are covered by a workplace retirement plan, the deduction for contributions to a traditional IRA is phased out for the following modified adjusted gross income (AGI) ranges:

Estate and gift tax

The annual gift tax exclusion remains at $14,000.

The gift and estate tax basic exclusion amount for 2017 is $5,490,000, up from $5,450,000 in 2016.

Personal exemption

The personal exemption amount remains at $4,050. For 2017, personal exemptions begin to phase out once AGI exceeds $261,500 (single), $287,650 (HOH), $313,800 (MFJ), or $156,900 (MFS).

Note: These same AGI thresholds apply in determining if itemized deductions may be limited. The corresponding 2016 threshold amounts were $259,400 (single), $285,350 (HOH), $311,300 (MFJ), and $155,650 (MFS).

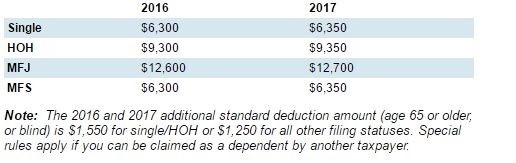

Standard deduction

These amounts have been adjusted as follows:

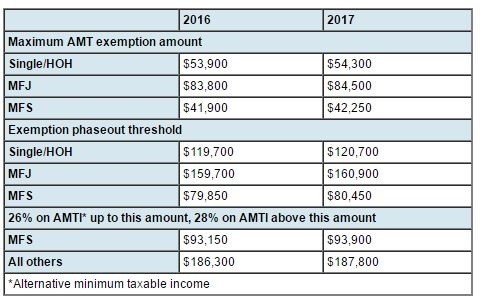

Alternative minimum tax (AMT)

AMT amounts have been adjusted as follows:

Content Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2016