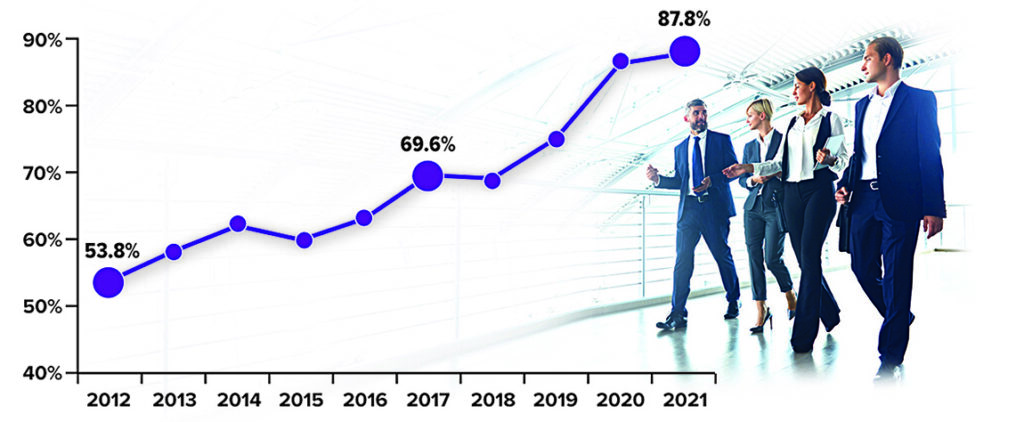

25 Sep Employee Access to Roth 401(k) Plans on the Rise

Roth 401(k) plans can offer an ideal opportunity to build a source of tax-free retirement income. There are no income restrictions to participate, they have much higher contribution limits than Roth IRAs, and they may offer employer matching contributions. And thanks to the SECURE 2.0 Act of 2022, beginning in 2024, Roth 401(k)s will no longer impose required minimum distributions in retirement. The percentage of employers offering a Roth 401(k) plan grew substantially from 2012 to 2021, a trend that may continue.

Qualified withdrawals from Roth 401(k)s are free of federal income taxes if the account is held for at least five years and the account holder reaches age 59½, becomes disabled, or dies. State income taxes may apply. Nonqualified withdrawals are subject to regular income taxes and a 10% penalty.

Source: Plan Sponsor Council of America, 2022

This information is general in nature, is not a complete statement of all information necessary for making an investment decision and is not a recommendation or a solicitation to buy or sell any security. Investments and strategies mentioned may not be suitable for all investors. Past performance may not be indicative of future results.

Prepared by Broadridge Advisor Solutions Copyright 2023.

Photo credit Viktoria Slowikowska at Pexels