24 Aug Stock Market Risks in the Spotlight

During March 2021, the widening availability of COVID-19 vaccinations, signs of improving economic conditions, and a third, $1.9 trillion stimulus package brought about more optimistic growth projections. Even though a healthy economy could be good news for many businesses and the financial markets, rising inflation expectations caused a multi-week sell-off in U.S. government bonds that pushed up longer-term yields and sent the Nasdaq Composite Index into correction territory on March 8, 2021.1

During March 2021, the widening availability of COVID-19 vaccinations, signs of improving economic conditions, and a third, $1.9 trillion stimulus package brought about more optimistic growth projections. Even though a healthy economy could be good news for many businesses and the financial markets, rising inflation expectations caused a multi-week sell-off in U.S. government bonds that pushed up longer-term yields and sent the Nasdaq Composite Index into correction territory on March 8, 2021.1

Promising a patient approach, the Federal Reserve stated that it would not raise interest rates until the labor market fully recovers and inflation moderately exceeds the 2% target for some time.2 But some investors worry that sharply higher inflation could force policymakers to boost rates sooner than originally expected.

Here’s a closer look at some specific types of investment risk that could influence individual stock prices and/or cause broader market swings during the second half of 2021.

Inflation and Interest-Rate Fears

Inflation and interest rates are two different but closely related investment risks. The Federal Reserve is tasked with fostering full employment and controlling inflation. One way it balances these two goals is by lowering interest rates to stimulate business activity or raising rates to help slow inflation when the economy is heating up too fast.

High inflation erodes the value of investment returns, but when interest rates rise, bond values fall (and vice versa). These risks are obvious considerations for bond owners, but they also impact stocks. When goods, services, and credit cost more, consumers have less purchasing power, which can hurt company earnings and stock prices as well.

Rising bond yields might continue to have a negative effect on stock values, because as they move up, borrowing costs for most businesses also rise, cutting into profits. Higher yields could also entice risk-averse investors to sell their stocks and buy more stable bonds instead.

Legislative or Regulatory Impacts

Some government actions (such as antitrust lawsuits, higher taxes, and more stringent regulations or standards) make it more difficult and expensive for companies to do business, which can adversely affect their earnings and stock prices. On the other hand, government subsidies and tariffs on foreign products can provide competitive advantages.

The Justice Department, Federal Trade Commission, and numerous states are in the midst of antitrust lawsuits or major investigations into the business practices of several market-dominating tech companies.3 In another example, the Securities and Exchange Commission is considering new standards for corporate disclosures related to environmental, social, and governance risks.4

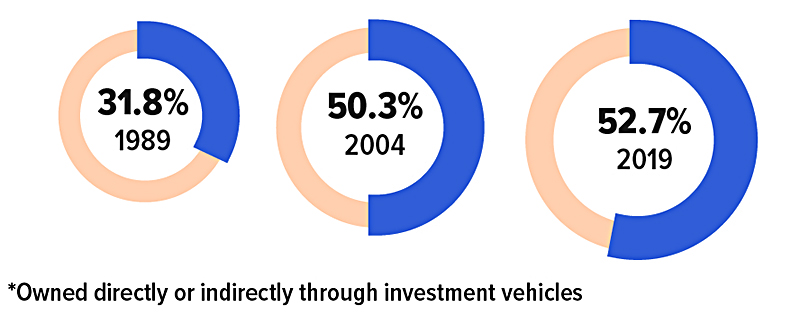

Percentage of U.S. Households Who Own Stocks*

Source: Investment Company Institute, 2021 (data from Federal Reserve Board Survey of Consumer Finances)

Event or Headline-Driven Volatility

Headline risk refers to the possibility that events reported in the media could hurt a company’s reputation and/or earnings prospects. Troubling news can cause market backlash against a specific company or an entire industry. Companies try to manage this risk through public relations campaigns and other efforts to generate positive news that leaves a good impression on consumers. Events that threaten to disrupt business activity nationwide, regionally, or around the world can cause sudden stock market declines.

The market responds to news, good or bad, almost every day. For this reason, your portfolio should be designed to weather a range of market conditions and have a risk profile that reflects your ability to endure periods of market volatility, both financially and emotionally.

The principal value of bonds may fluctuate with changes in interest rates and market conditions. Bonds redeemed prior to maturity may be worth more or less than their original cost. The return and principal value of stocks fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. Investments seeking to achieve higher yields also involve a higher degree of risk.

1) The Wall Street Journal, March 8, 2021

2) Federal Reserve, March 17, 2021

3) Reuters, December 16, 2020

4) The Wall Street Journal, February 24, 2021

This information was developed by Broadridge, an independent third party. It is general in nature, is not a complete statement of all information necessary for making an investment decision, and is not a recommendation or a solicitation to buy or sell any security. Investments and strategies mentioned may not be suitable for all investors. Past performance may not be indicative of future results.

Prepared by Broadridge Advisor Solutions Copyright 2021.